Where Your Next Chapter Begins

Why Buy with Engel & Völkers Snell Real Estate?

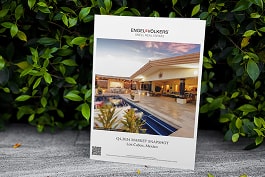

- Exclusive Listings

Access properties with unmatched luxury and value. - Expert Guidance

Providing expert guidance every step of the way - Personalized Service

Receive tailored service and unmatched market insight.

At Engel & Völkers Snell Real Estate, buying a property is more than a transaction — it’s a personalized, world-class experience tailored to your vision of luxury living.

- Exclusive Listings

Access properties with unmatched luxury and value. - Expert Guidance

Providing expert guidance every step of the way - Personalized Service

Receive tailored service and unmatched market insight.

Explore Our Advanced

Property Search Tool

Our advanced property search tools make it simple to find the perfect home. Key features include:

- MLS and exclusive listings access

- Interactive map for location-based searches

- Filters for price, location, and property type

Your Complete Experience

Market insights & reports

Stay informed with updates on the luxury market trends, helping you make data-driven decisions for your property investment.

community connections

Gain a deeper understanding of each neighborhood’s lifestyle, amenities, and unique charm to find the perfect fit for you.

luxury experiences

Let us connect you with local events, luxury amenities, and exclusive experiences to enrich your living experience.

Your Guide to Buying in Baja

At Engel & Völkers Snell Real Estate, we’re committed to making your buying journey seamless with expert, step-by-step guidance tailored to you.

Personalized Consultation

An in-depth discussion to understand your goals, preferences, and investment parameters.

Curated Property Selection

We present a tailored portfolio of exclusive listings aligned with your vision and lifestyle preferences.

Private Tours & Property Visits

Experience personalized tours of select properties, with insights on the lifestyle, amenities, and community of each.

Offer Strategy & Negotiation

Receive expert guidance on crafting competitive offers and negotiating terms to secure the best opportunity.

Due Diligence & Compliance

We assist with inspections, appraisals, documentation, and ensure every step meets legal and regulatory standards.

Closing & Beyond

From contract to keys, we deliver comprehensive support to ensure a smooth closing — and continue to assist after the sale.

Begin Your Seamless Buying Experience

Frequently Asked Questions

Can foreigners own real estate in Mexico?

Yes. Foreigners can legally own property in Mexico through a Fideicomiso, a Mexican bank trust. This structure grants full ownership rights for 50-year terms (renewable indefinitely), allowing you to buy, sell, rent, or will the property as desired.

What is a Fideicomiso?

A Fideicomiso is a trust agreement established with a Mexican bank, allowing non-Mexican citizens to own property within restricted zones. The bank holds the title as trustee, while you, as the buyer and beneficiary, retain trustee and usage rights.

How long does it take to establish a Fideicomiso?

The process of setting up a Fideicomiso typically takes 60–90 days, depending on the property and involved parties. In some cases, it may be completed in as little as 2–3 weeks. This timeline will largely depend on the trust bank involved, as some institutions have more complex and extensive procedures than others.

Do I need title insurance when buying property in Mexico?

Yes. Title insurance is strongly recommended to confirm clear title and protect your investment. Engel & Völkers Snell Real Estate facilitates title insurance on all transactions for peace of mind and additional security.

What rights do I have as a property owner in Mexico?

As the beneficiary of a Fideicomiso, you hold the same rights as a property owner in the U.S. or Canada. This includes the right to sell, lease, remodel, inherit, or transfer the property at any time. It’s important to note that while you do hold these rights, any sale, inheritance, or transfer of the property must involve the trust bank. Typically, the bank will not object to carrying out your wishes, as long as all formal requirements—such as submitting the necessary documentation and paying any applicable trust fees—are properly met.

How do I ensure my property purchase is secure?

Your purchase is protected through U.S-based third-party escrow services, which ensure funds are held securely and only released upon completion of title transfer. Our experienced team also provides full transaction guidance to ensure transparency, confidence, and a seamless experience throughout the process. Additionally, it is highly recommended to engage a lawyer who specializes in this area to ensure the transaction complies with all applicable local laws and to protect the interests of the client—whether buyer or seller, as the case may be.

Are there financing options available for foreign buyers in Mexico?

Yes, although most real estate transactions in Baja California Sur are cash-based, financing options do exist. Some developers offer direct financing, while select Mexican banks provide loans to foreign buyers. Terms vary, and a fiduciary guarantee is typically required to secure repayment. Our advisors can guide you through the options that best suit your needs.

What are the typical closing costs for buyers in Mexico?

Buyers should plan for closing costs of approximately 4%–7% of the property’s value. These may include notary fees, property transfer tax (3% in Baja California Sur), title registration fees, appraisal fees, legal fees, and Fideicomiso setup costs. Title insurance, while optional, is also highly recommended. This percentage will vary depending on the purchase price of the property. Generally, the higher the purchase price, the lower the overall percentage, as certain fees are fixed regardless of the property’s value. However, the total closing costs will typically start at around 3%, primarily due to the ISABI (Real Estate Acquisition Tax), which represents the most significant portion. Other associated expenses may vary depending on the specific transaction.

Should I get a home inspection before purchasing?

Absolutely. While not legally required, a home inspection is strongly advised—especially for resale properties. It helps identify any structural, electrical, or plumbing issues and can serve as a negotiation tool. Even new construction should be inspected for quality assurance before final delivery.

What happens after I close on the property?

Once the final deed is signed and ownership is transferred, the notary will obtain the trust bank’s signature—a process that typically takes 1 to 2 weeks. Following this, the notary registers the transaction with the Cadastral Office (property tax authority) and the Public Registry of Property. Your advisor will support you through the handover process, including assistance with utility transfers, service account setup, and ongoing ownership responsibilities such as annual property tax payments.

Contact us today to get personalized guidance and ensure a smooth and secure property buying experience in Baja.